kentucky sales tax calculator

Select the Kentucky city from the list of popular cities below to see its current sales tax rate. Kentucky State Sales Tax Formula Sales Tax Rate s c l sr Where.

Kentucky Sales Tax Rates By City County 2022

There are no local sales and use taxes in Kentucky.

. The average cumulative sales tax rate in Albany Kentucky is 6. Kentucky Sales Tax Calculator Purchase Details. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees.

Youll then get results that can help provide you a better idea of what to expect. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Albany is located within Clinton County KentuckyWithin Albany there is 1 zip code with the most populous zip code being 42602The sales tax rate does not vary based on zip code.

It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. You can find these fees further down on the page. Kentucky Income Tax Calculator 2021.

How to Calculate Sales Tax. The wage base is 11100 for 2022 and rates range from 05 to 95. Kentucky does not charge any additional local or use tax.

To lookup the sales tax due on any purchase use our Kentucky sales tax calculator. Overview of Kentucky Taxes. However as of June 2019 there are.

In zip code Enter the zip code where the purchase was made for local sales tax Whenever you make a purchase at a licensed Kentucky retailer your sales tax will be automatically calculated and added to your bill. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. Kentucky KY Sales Tax Rates by City Kentucky KY Sales Tax Rates by City The state sales tax rate in Kentucky is 6000.

Find list price and tax percentage. Multiply the vehicle price before trade-ins but after incentives by the sales tax fee. But the sales tax is not charged no the staple grocery foods.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. How are trade-ins taxed.

For Kentucky it will always be at 6. Kentucky sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Well speaking of Kentucky there is a general sales tax of 6. Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected.

Do Kentucky vehicle taxes apply to trade-ins and rebates. Download state rate tables Get a free download of average rates by. Divide tax percentage by 100 to get tax rate as a decimal.

You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Sales Tax calculator Kentucky. For example the sale of a 200000 home would require a 200 transfer tax to be paid.

Unless youre in construction then your rate is 10. There are no local taxes beyond the state rate. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

There are two unique aspects of Kentuckys tax system. If youre a new employer youll pay a flat rate of 27. Avalara provides supported pre-built integration.

Download Or Email Form 740-ES More Fillable Forms Register and Subscribe Now. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. Multiply the price of your item or service by the tax rate.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Both the sales and property taxes are below the national averages while the state income tax is right around the US. Remember paying your SUI in full and on time qualifies you to get a whopping 90 off of your FUTA tax bill so make sure you pay attention to the due dates.

Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually. 100s of Top Rated Local Professionals Waiting to Help You Today. Sales and Gross Receipts Taxes in Kentucky amounts to 65 billion.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and special taxation districts. All you do is connect the channels through which you sell including Amazon eBay Shopify Square and more and well calculate exactly how much sales tax you collected. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

The tax is collected by the county. How to Calculate Kentucky Sales Tax on a Car To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Kentucky imposes a flat income tax of 5.

How to Calculate How Much Sales Tax You Owe in Kentucky Calculating how much sales tax you should remit to the state of Kentucky is easy with TaxJars Kentucky sales tax report. It is 4891 of the total taxes 134 billion raised in Kentucky. This includes the rates on the state county city and special levels.

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. The base state sales tax rate in Kentucky is 6. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753.

The tax rate is the same no matter what filing status you use. In many states localities are able to impose local sales taxes on top of the state sales tax. Kentucky first adopted a general state sales tax in 1960 and since that time the rate has risen to 6 percent.

Motor Vehicle Usage Tax. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. Kentucky state sales tax rate 6 Base state sales tax rate 6 Total rate range 6 Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates.

For most counties and cities in the Bluegrass State this is a percentage of taxpayers. Find your Kentucky combined state and local tax rate. Kentucky Sales Tax Calculator and Economy Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind of sales tax youll see in Kentucky.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Which products are exempt from the tax. Kentucky Sales Tax Calculator You can use our Kentucky Sales Tax Calculator to look up sales tax rates in Kentucky by address zip code.

Previously until April 1 2009 alcohol sales were exempt. Sales and Use Tax Laws are located in Kentucky Revised Statutes Chapter 139 and Kentucky Administrative Regulations -. Then use this number in the multiplication process.

Local tax rates in Kentucky range from 600 making the sales tax range in Kentucky 600. There are items products that are taxed but still there is a list of the items that are non-taxable. S Kentucky State Sales Tax Rate 6 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate The goods news is that Kentucky sets its Sales Tax Rate as a flat rate across the State so although the Sales Tax Formula Still applies.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Kentucky Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Car Tax By State Usa Manual Car Sales Tax Calculator

State Corporate Income Tax Rates And Brackets Tax Foundation

States With Highest And Lowest Sales Tax Rates

Kentucky Salary Calculator 2022 Icalculator

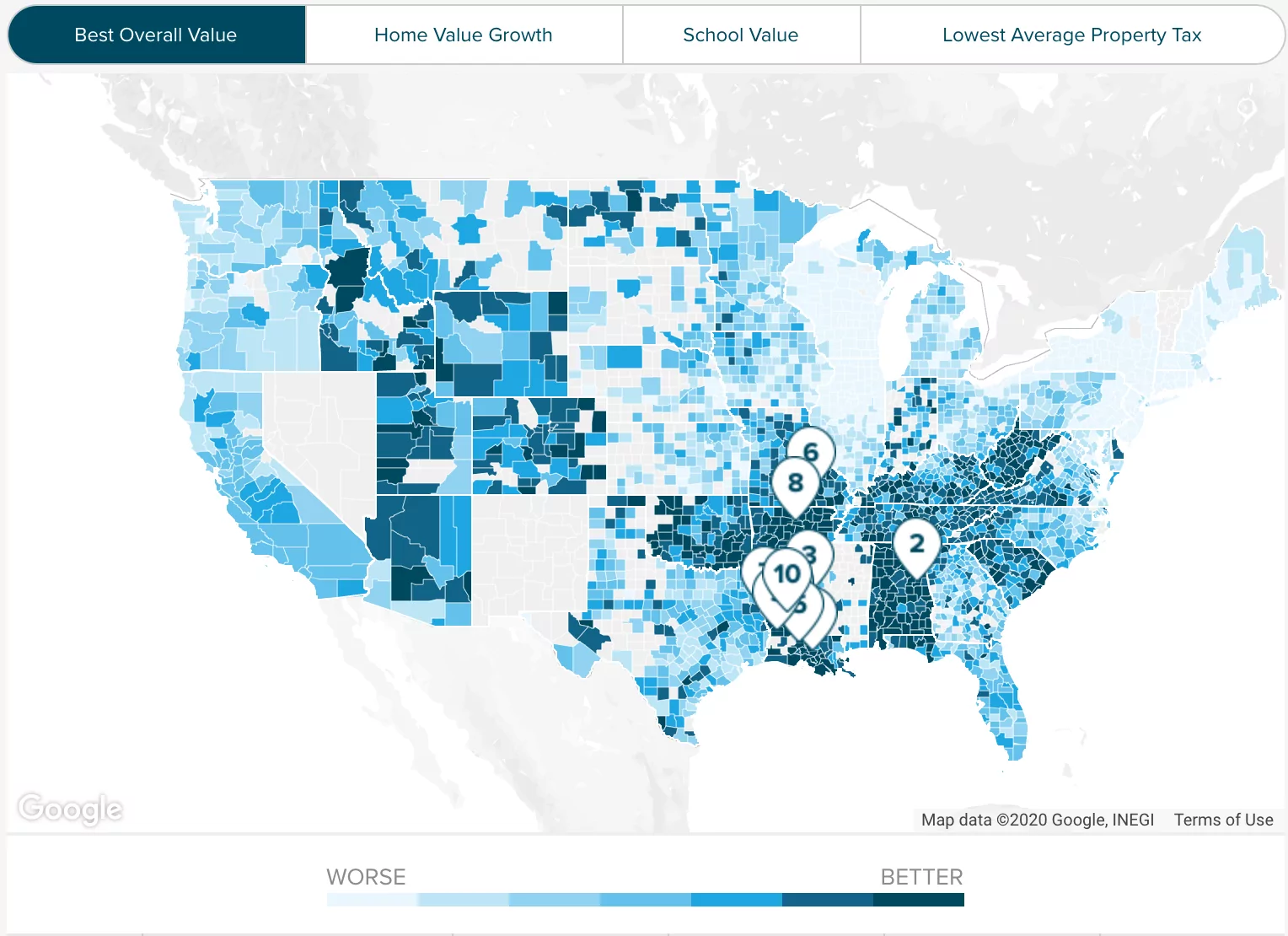

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Hawaii Sales Tax Calculator Reverse Sales Dremployee

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Jefferson County Ky Property Tax Calculator Smartasset

Sales Tax On Grocery Items Taxjar

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Sales Tax Guide And Calculator 2022 Taxjar

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price